Isn’t it curious how the word valuable means different things in different contexts?

This past month of the lockdown has made me reflect on what truly is valuable to me. Some of you may have done the same too.

I have thought about what brings meaning and purpose to my life, my vision which translates to having goals and desired pathways to reach those goals. And I have even reflected on my consumer behavior. What would I buy and why, have I saved enough for a rainy day, have I invested wisely? Has my perspective changed in the last month (and more) since the lockdown? I realized that the lockdown actually made me recognize the feedback loop between financial planning and mental & physical health.

Let me take a step back and go back to the basics.

There are some key values that our parents teach us, especially in a country like India, where parents are the main socializing agents and where joint families still exist. Here are some key credos my parents lived by, role-played for us, and taught us about:

- You have to be independent and stand on your own feet. Financially foremost.

- “Jitni chaadar lambi ho, utney hee pair phailaaney chahiye.” (“Stretch your legs only as much as the length of your blanket.” In other words, live within your means.)

- Always keep some money hidden away in a section of your wallet. Keep it as a reserve and use ONLY in case of an emergency.

- We (parents) repeat, you have to be self-reliant & resilient in every way.

- Take care of your health proactively.

I reflect back to these credos and realize how these became a core part of me growing up. And from thereon follows the link between financial, mental, and physical well-being. My parents taught me well.

I learnt to live within my means and continue to save enough from my earnings in case a crisis ever hits. We’ve invested our earnings wisely to reap some dividends. But perhaps my most proactive investment is in my overall mental and physical health.

This is also my most important investment for several reasons:

a) Being optimistic, calm even in the face of crises, being goal-driven, resilient, self-efficacious, proactive, and collaborative makes me function at my best personally and professionally.

b) Being in good physical health (thanks to being a marathoner) keeps me energized through the day so that I can focus on all the tasks at hand, and that further reaffirms my mental grit and strength.

c) Being healthy further prevents frequent visits to the hospital and extra expenses of procedures, medicines, and other treatments. I save prudently on big healthcare costs.

And so, money gets invested where it acts as a buffer when the going may get tough or for when I eventually retire. I try to live well within my means, and keep my lifestyle modest. My only indulgence is travel and we try to plan that well making sure our investments and savings don’t get affected. I am grateful for all that I have, and everything that continues to come my way.

The lockdown brought home a point my parents have always known: Thoda hai, thodey ki zaroorat hai/Zindagi phir bhi yahan khoobsoorat hai (“There is little, little is what I need / life here is beautiful still.”)

During this current crisis, the seas have gotten turbulent and rough, the boat was rocked, but I could adjust the sails to manage the tough course. That much was in my control.

But I recognize that what the lockdown did also was throw people off track and cause immense stress.

But what exactly do I mean by stress? It’s important to understand and highlight that in order to illustrate the feedback loop (which I’ll come to in just a minute).

Stress is a nonspecific reaction in our bodies in response to a real or imagined threat. It’s manifested physically (such as aches and pains, difficulty sleeping, nausea, loss of appetite etc.), mentally (difficulties in concentration, decision making, memory), emotionally (feeling tense, anxious, worried, sad, irritable, angry), and behaviorally (e.g., absenteeism from work, crying, shouting, blaming).

In these unprecedented times with the covid-19 outbreak and its imposed lockdown, life has brought to a grinding halt to what once was routine and normal.

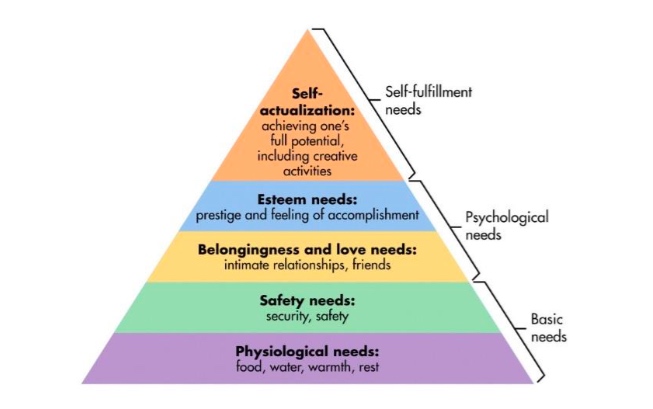

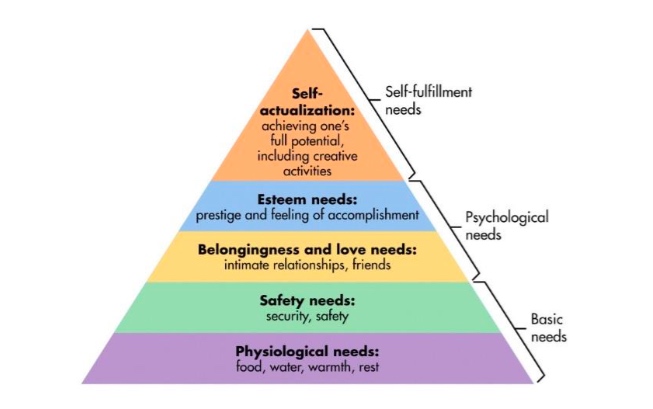

Our basic physiological needs of food, water, shelter, and breathing have been under threat like we have never known before in our lifetimes. Our comfort of feeling safe and secure has also been compromised where our financial resources, vocational status, health, and social stability are under question. Yes, I am referring to Maslow’s hierarchy of needs which still holds true even in 2020, 77 years after it was first published.

When these needs are unmet or inadequately met, stress results.

“The fear of the unknown” is a fundamental fear underlying our anxieties.

It’s fanned by the absence of clarity in the information that the media spews out, barring the numbers of rising covid cases nationally. When will the lockdown end? What will happen to our jobs? Will I even get a salary this month? What if I get laid off? What about my savings and investments? The uncertainties and the absence of a path ahead fuels our fear. Financial insecurities are looming large and we may not have kept aside enough to tide by the months of expenses that will continue to show up: EMIs, utility bills, school fees, salaries of staff, groceries, etc.

And thus begins the downward spiral, triggering stress that manifests physically and emotionally.

People with unhealthy coping mechanisms such as resorting to alcohol and drug use or emotional eating are more prone to sedentary behaviors such as being on the web or surfing TV mindlessly.

Our physical health takes a turn for the worse which then directly influences our financial health. This vicious feedback loop results in a financial drain by increasing medical expenses, reduced productivity at work, being depressed and anxious, all of which pose significant obstacles in making sound financial decisions, to think proactively, to anticipate and plan the future, to take charge of life, to problem solve.

The stress further rises, and we decide to cut corners to avoid unnecessary expenditure. The first thing to take a hit is healthcare. We avoid consultations with doctors, necessary diagnostic tests, required treatments, because of the high cost involved. The spiral deepens, with a person now being financially, physically, mentally, and emotionally depleted.

“If only I had saved and invested wisely.” “How will I make all these regular monthly payments and manage my expenses?” “I see debt looming large.” “I now see the flaw in my foolhardy outlook of “live for the moment, don’t save.” “What will I do now to deal with this?”

And sometimes, despite our best efforts, our most prudent decisions also backfire because of factors beyond our control. (Remember “investments are subject to market risks?”)

The stress further builds up and the vicious cycle further spirals out of control. Till we decide to break the chain and contain its devastating effects.

So how exactly can we do that?

The first place to begin is to manage one’s emotions and become emotionally resilient. We can never think through a problem when our mind is racing, overwhelmed, and we feel hopeless and helpless. We have to garner the strength to think through calmly, to take informed decisions, to be proactive in managing our overall well-being: emotionally, physically, vocationally, socially, financially, to name the important domains.

Being resilient means having a vision, a reasonable plan for the future taking in mind that life may throw a googly at any point. It means being proactive, being able to bounce back from adversity, being able to problem solve.

How can we improve our financial behaviors? Can I reflect on the areas I spend on, and how I can be mindful of resource allocation? How can I invest and save wisely?

The answers I have will seem commonsensical, but that’s precisely why they will work.

They stem from planning emphatically and empathetically for one’s future, by creating a budget that allows for expenses and savings, by consulting a financial advisor and other experts who can guide you, and most importantly, by engaging in health promoting behaviors to steer towards the wellness spectrum rather than doing nothing and inching towards illness and pathology.

The illustration below will clearly show you where your financial resources will end up being depleted, barring, of course, diseases and illnesses that are not linked to dysfunctional lifestyle choices.

Here’s the bottom line. What happens in the markets, in the external world, in the eyes of other people—none of these is in your control.

You are in your control, though. And that is the biggest insight I can share with you.

You have to reflect on the way you have crafted your lifestyle choices and its plan till now. Has it taken all dimensions of well-being in consideration? We often think wellness is only the absence of disease, and being physically and mentally fit. The fact of the matter is, it is interrelated across seven dimensions: Physical, Emotional, Intellectual, Spiritual, Social, Vocational, & Environmental.

Striving towards paying attention to where the balance is tipping over, assuming responsibility for our own self to know the causes and consequences of our own behaviors, being proactive, forward moving, and taking deliberate action where needed is where our focus needs to be.

The covid-19 pandemic has shown us a mirror. What we choose to do now with what the reflection is showing us, is upto us. Move…onward and upward. And connect the dots between our fiscal, physical and mental well-being. That way, your mental wealth will not be subjected to market risks.

Author Bio

Dr. Divya Parashar, a Clinical & Rehabilitation Psychologist with over 20 years of experience. She has co-authored a book titled “Move: Get Fit in 15 Weeks,” and her work has also been published in peer reviewed journals.